All Posts (10733)

Article Excerpt: Our 2011 survey found that the median expectation for home price appreciation next year is just 1%. So it won’t be surprising if new home sales remain abysmally low and few jobs are created in the hard-hit construction industry. And it shouldn’t be a shock if the personal savings rate stays at around 5%, as it has recently, up from around 1% in 2005. This would mean that consumer spending will not drive a strong recovery.

http://www.nytimes.com/2011/06/12/business/economy/12view.html?_r=2

A quick update .... From our EW analysis we've been expecting a bottom to form on the Dow followed by a major rally. The action today certainly looks like an impulsive wave 1 up. The sell off at the end of the day looks like a wave 2 correction before a substantial wave 3 rally gets started. With CCI looking so oversold at the end of the day I've taken a small long position but wave 2 could still go down to near the start of wave 1 which is down at about 12025 on the Dow. I've drawn in green the "perfect" correction to generate a buy signal which would involve a triangle half way down to form the "B" in an "ABC" correction.

This chart shows what I think was the bottom on the Dow with a corrective triple before todays rally. I've overlaid an example of a triple onto the chart:

As you can see the action is very messy but it seems to fit quite well. Corrections are notoriously difficult to interpret. Let's see what tomorrow brings!

That's what the Dow looked like today, and without the benefit of hindsight you would be lucky not to lose your shirt and have your head handed to you on a silver plate!

As mentioned in yesterdays post, last night's sell off looked like it could be the start of a big sell off - ie it was wave 1 down leaving the Dow looking very oversold and we were looking for some kind of wave 2 rally today before going short to catch wave 3 down.

Corrections can often be notoriously difficult to understand though.

An hour after the open it looked like we'd had a simple ABC correction:

The red 1 & 2 show the biggest picture - ie I thought we'd seen the end of the correction and we were headed down. Wave 2 red broke down into an ABC move (labelled green). The triangle in the middle was the clincher - triangles only occur in waves 4 or B according to EW. So seeing a rally followed by a triangle you only had to count another 5 wave rally to give you a very low risk entry. As it happened that rally stopped at a horizontal line that was already on the chart from a previous support/resistance level so perfect! A very low risk entry point to go short.

Unfortunately after the initial sharp sell off the selling stopped and it quickly became apparent that this was not the start of a big drop so time to get out and re-evaluate. That demonstrates the power of EW though, even if the overall picture doesn't show you what is really unfolding you still have a very low risk entry point where you can catch a change in direction and quickly set a stop at b/e.

Moving on to the bigger picture, I'm going to stay on the sidelines for now. I was looking for a wave 2 correction today but the action looked like a triangle which suggests this cannot be a wave 2. The overnight Nasdaq action suggests the triangle was wave 4 and the following move down was wave 5 so the sell off is over. On the other hand the Dow action on a 10 min chart looks more like a neat bear flag than a triangle.

Time to sit back and see what happens next I think - "If in doubt stay out!!!"

In the short term these stocks will most likely remain under significant pressure until more clarification can be gained. While their valuation seems attractive, if nationalization does become a reality, they will go much lower. Stay tuned to this story and be ready for the trade. To get more insight, analysis, swing trades and guidance, take the seven day free trial to the Research Center. Click here.

Gareth Soloway

Chief Market Strategist

www.InTheMoneyStocks.com

This is my Elliott Wave view of the last few days action. We've seen a clear 5 wave move down followed by a correction. Triangles can only appear in waves 4 or B so when the triangle shown tried to break down last night I thought it was a wave 4 correction with wave 5 down to come. However it seemed to be a fake out which suggested a rally instead today for wave C before we start sliding down again. (I will post a shorter timeframe chart below to illustrate)

So for the rest of the week? Indices are looking very oversold tonight so I would expect a pullback (rally) of some sort tomorrow before wave 3 kicks in and we have a powerful sell off. Today was wave 1 down, once we complete another full 5 wave move down there is a big rally on the cards IMO.

Above you can see the triangle I mentioned earlier. You can see the fake out (circled in red) but looking very oversold with divergence it went nowhere. When the triangle broke to the upside this morning it pulled back to the line which is the low risk entry point when trading a triangle breakout. You can also see at the end of today that sell off looking oversold and needing a pull back before heading lower.

Finally a closer look at today on the 1 minute chart:

Sorry if that isn't the clearest chart, I don't have the best tools for illustrating what I see. If you had recognised the triangle in the earlier charts as being wave B then you would be ready to count the breakout of the triangle as a wave C which should have 5 waves. Within those 5 waves, waves 1, 3 & 5 which are the rallies should each break down into 5 waves themselves. Wave 1 had 5 sub waves (in blue), wave 3 had five (in red) and wave 5 had 5 in green.

The top of wave C was fairly easy to spot if you were looking for it and gave a low risk short entry to catch the sell off that followed.

We've seen a powerful sell off today. I would expect a rally tomorrow (wave 2 correction) before an even more powerful sell off (wave 3) begins. Note: wave 2 can often retrace very deeply into wave 1!

I hope the above charts make sense to any non Elliott Wavers and maybe they will encourage people to take a look at EW and perhaps adopt it as a powerful trading tool!

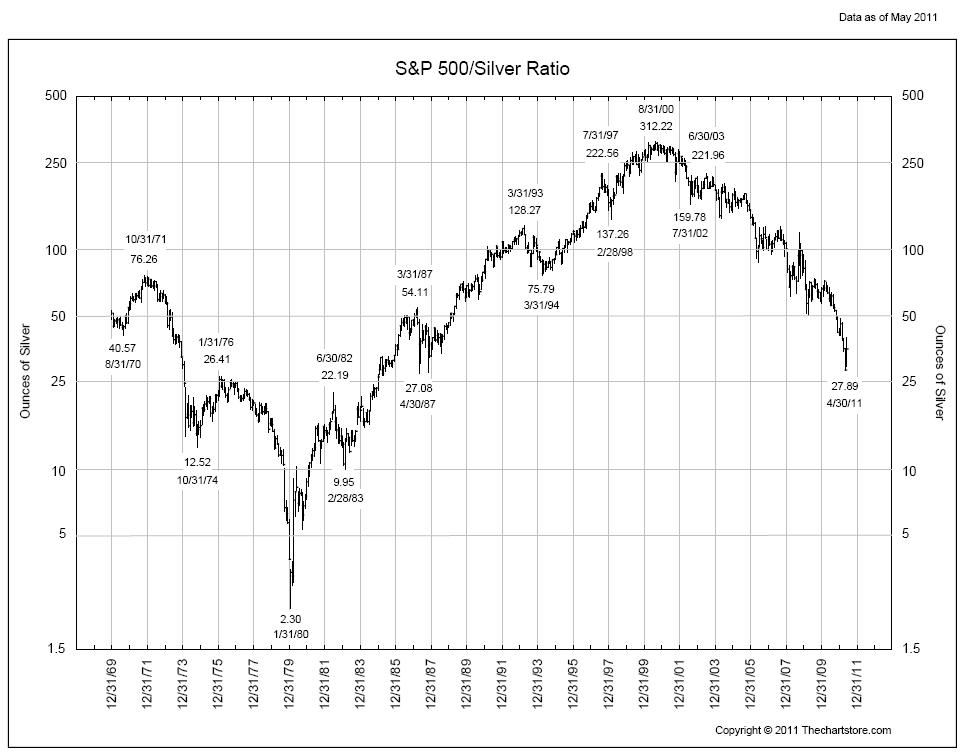

Several readers have been asking me how I feel about Silver and $SLV. I think the answer depends on what your time frame is. I’ve been saying all along that I believe Precious Metals have been outperforming Stocks for over a decade and that I don’t think that trend has changed or is going to change any time soon. Below is a chart of the S&P500 priced in Silver. It is clear that this is a downtrend for Equities relative to Silver. We are going to watch this ratio closely for any changes or divergences.

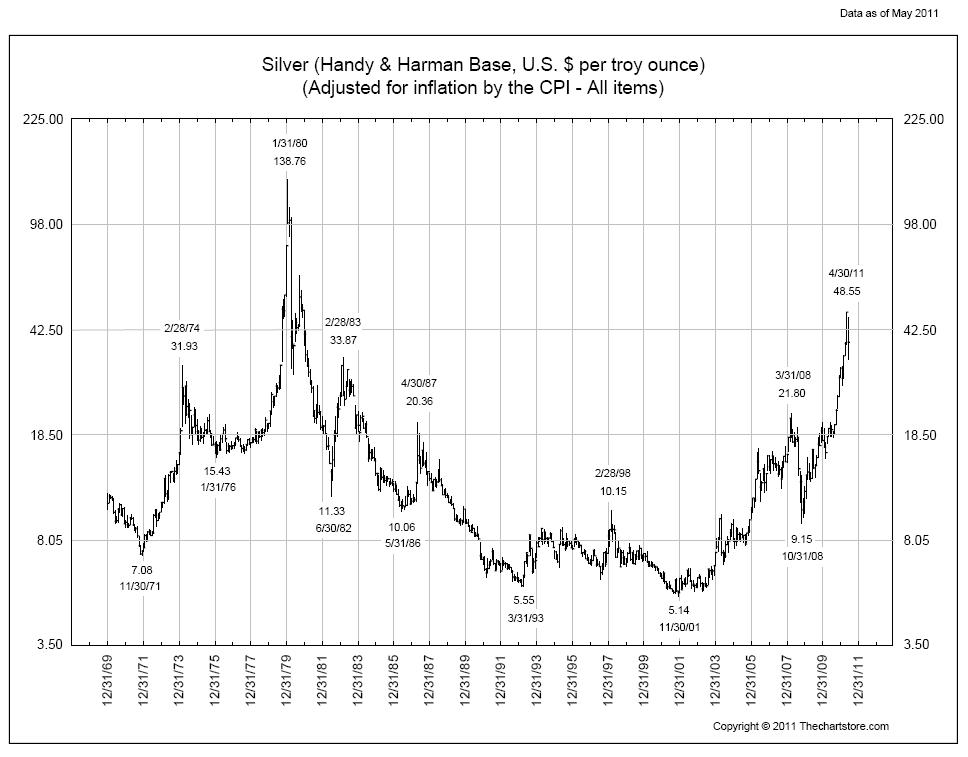

On an inflation adjusted basis, we still have a long way to go before Silver gets back to the 1980 highs. TheChartStore does a great job of adjusting the Precious Metal for inflation using the Consumer Price Index.

The intermediate term picture looks pretty complete. Looking at $SLV below, the measured move (blue line) from the breakout out of the most recent consolidation slightly exceeded it’s target. This is a normal move after a breakout like this. Now it appears like Silver needs to regroup, consolidate, and make it’s next move higher. This could take some time. Look how it took almost took two and a half years for $SLV to take out the 2008 highs. Good things take time.

Now we want to look at the near term. After reaching it’s peak in April, $SLV found support at the 50% retracement, which again, is normal. If the May low can’t hold, then a retest of $29-$30 is inevitable. This would still be a normal correction within the context of this secular advance.

Now looking at the ultra-short term, here is a 60-min chart of $SLV. Peter Brandt made some good points about the Inverse Head & Shoulders that has been forming over the last month. If this indeed leads to a breakout, we could see a measured move to the mid 40s, but a failure of this pattern should lead to new lows and perhaps that test of $29-$30 that we discussed above. The key level here is the (would-be) neckline around $38.

I would expect that volatility in this area is here to stay. We saw record volume in late April and early May so it should take some time for this market to recover and regain it’s strength. This, however, does not change the big picture where we see Silver continuing to outperform equities over the long run.

Today, the global economic system is even more vulnerable than it was back in 2008. Virtually none of the systemic problems that contributed to the 2008 collapse have been fixed.

Mark Mobius, the head of the emerging markets desk at Templeton Asset Management, was recently was quoted in Forbes as saying the following....

"There is definitely going to be another financial crisis around the corner because we haven’t solved any of the things that caused the previous crisis."

The "financial reform" law that Barack Obama and the Congress passed a while back was a complete and total joke. They might as well have written the law on toilet paper for all the good that it is doing.

We did not learn from our mistakes and our future economic lessons are going to be even more painful.

The world is drowning in a mountain of debt, the global financial system is packed to the gills with toxic derivatives, everyone is leveraged to the hilt and the dominoes could start falling at any time.

I am not the only one that is warning that another financial collapse is coming. In fact, a whole lot of people have been warning about the next financial collapse lately.

So what will the tipping point for the next collapse be?

The following are some potential nominees....

Tipping Point #1: Syria

Syria is a situation to watch very, very closely. The Syrian government is in a lot of trouble right now. Sadly, the instability inside Syria probably makes war with Israel even more likely.

Make no mistake - a war between Israel and Syria has been brewing for a long, long time and at some point it will happen. When it happens, the entire Middle East may erupt in warfare.

Just the other day, a very troubling incident happened in the area around the Golan Heights. The following is an excerpt from a report by The Daily Mail about the incident....

"About 20 pro-Palestinian demonstrators were killed and 325 injured yesterday when Israeli forces opened fire on them as they crossed the border from Syria into occupied territories, according to reports."

At this point, the Syrian government is probably glad that the attention has been taken off of them at least for a while. The Syrian government has been getting a lot of bad press lately. The following is an excerpt from a recent report by Human Rights Watch about the treatment of protesters inside Syria....

"The methods of torture included prolonged beatings with sticks, twisted wires, and other devices; electric shocks administered with Tasers and electric batons; use of improvised metal and wooden 'racks'; and, in at least one case documented by Human Rights Watch, the rape of a male detainee with a baton.

"Interrogators and guards also subjected detainees to various forms of humiliating treatment, such as urinating on the detainees, stepping on their faces, and making them kiss the officers' shoes. Several detainees said they were repeatedly threatened with imminent execution."

So in light of the "precedent" that we recently set in Libya, does this mean that we will be "forced" to conduct a "humanitarian mission" inside Syria as well?

Syria is one tipping point that we all need to keep a close eye on.

Tipping Point #2: Iran

The Iranian nuclear program is in the news again. A new report by RAND Corporation researcher Gregory S. Jones claims that Iran could have a nuclear weapon within 2 months. His report is based on recent findings by the International Atomic Energy Agency. According to Jones, airstrikes alone would be incapable of stopping Iran's nuclear weapons program at this point. Instead, Jones says that a "military occupation" would be required.

It is a minor miracle that a war with Iran has not erupted yet. It seems almost inevitable that at some point either the United States or Israel will use military force to try to stop Iran's nuclear program.

When that happens, it is going to cause a major shock to the global economy.

Tipping Point #3: Libya

NATO has made it abundantly clear that Moammar Gadhafi will no longer be tolerated. In fact, NATO apparently plans to reduce Tripoli to a heap of smoking ruins if that is what it takes to bring about the fall of Gadhafi.

What a "humanitarian mission" we have going in Libya, eh? It turns out that NATO believes that the United Nations gave it permission to bomb television stations and to make attack runs with helicopters.

Russian Deputy Prime Minister Sergei Ivanov recently said that by using attack helicopters, NATO has moved dangerously close to turning the Libya operation into a ground invasion....

"Using attack helicopters, in my view, is the last but one step before the land operation."

So why is Libya a potential tipping point?

It isn't because Gadhafi is a threat. He is toast.

It is because the rest of the world is watching what is happening in Libya, and that is raising global tensions.

Even if Gadhafi falls, the Libyan operation will still be a failure because it has brought us all significantly closer to World War III.

Tipping Point #4: More Revolutions In The Middle East

The revolutions throughout the Middle East earlier this year sent oil prices absolutely skyrocketing and they have remained at elevated levels.

And in case you haven't noticed, revolutions continue to sweep the Middle East.

Have you seen what has been happening in Yemen lately?

Yemeni President Ali Abdullah Saleh has burns over 40% of his body and he has suffered a collapsed lung as a result of a recent attack.

If violence and protests throughout the Middle East become even more intense as the weather warms up this summer that could have a very significant impact on world financial markets.

Tipping Point #5: Fukushima

The mainstream news has gotten a bit tired of covering it, but the situation at Fukushima is still a complete and total disaster.

Japan's Nuclear Emergency Response Headquarters admitted on Monday that three reactors experienced "full meltdowns" in the aftermath of the earthquake and tsunami in March.

Did it really take them nearly three months to figure this out, or were they lying to the rest of the world all of this time?

The truth is that the nuclear disaster at Fukushima is far worse than the mainstream media has been telling us. If you doubt this, just check out this excellent article or this article by Natural News: "Land around Fukushima now radioactive dead zone; resembles target struck by atomic bomb".

The economic impact of the Fukushima disaster is going to continue to unfold over an extended period of time. It turns out that Japan is now officially in a recession. Their economy contracted at a 3.7 percent annualized rate during the first quarter.

Look for more bad economic numbers to come out of Japan for the rest of the year. Considering the fact that the Japanese economy is the third largest economy in the world, the fact that they are struggling so badly right now is not a good sign for the rest of us.

Tipping Point #6: Oil Prices

The price of oil is going to continue to be one of the biggest economic stories for the rest of this year and for 2012 as well.

The last time U.S. energy expenditures were over 9 percent of GDP was in 2008 and we quickly plunged into the deepest economic downturn since the Great Depression.

Well, we have reached the significant 9 percent figure once again in 2011, and many fear that once again high oil prices will cause another major economic decline.

Tipping Point #7: Government Austerity

In the United States, it is not just the federal government that is drowning in debt.

All over America, there are state and local governments that are financial basket cases.

I don't always agree with the time frames that Meredith Whitney puts out there, but she is absolutely correct that we are going to see a massive municipal bond crisis. The following is an excerpt from a recent report about Whitney's predictions on CNN....

"Meredith Whitney is issuing a fresh warning to mutual funds, banks, and politicians: The state of state finances is far worse than what you think, or at least than what you've been willing to tell the investors and taxpayers who will eventually carry the burden."

Many state and local governments are attempting to get their budgets balanced by making huge budget cuts. But most of the time these austerity programs also include the elimination of a lot of government jobs.

UBS Investment Research is projecting that state and local governments will combine to slash a whopping 450,000 jobs by the end of next year.

So where will the half a million good jobs come from to replace all of those lost jobs?

Tipping Point #8: The European Sovereign Debt Crisis

Greece is just the tip of the iceberg in Europe.

Moody's downgraded Greek debt again last Wednesday. This time Moody's downgraded Greek debt by three levels all the way down to Caa1. At this point, the yield on 10-year Greek bonds is over 15 percent.

The EU has been going crazy trying to deal with the Greek debt crisis. The truth is that a default by the Greek government would be absolutely catastrophic. If you do not understand the kind of chaos a Greek default would set off on world financial markets, just read this editorial.

But Greece is not the only major European nation with a massive debt problem.

The government of Ireland is already indicating that they may need another bailout.

Portugal, Spain and Italy are also on the verge of collapse.

So will the EU bail all of these nations out for years and years to come?

At some point will the whole house of cards come crashing down?

Everyone needs to keep watching what is going on in Europe. The status quo is not sustainable and it cannot go on forever.

Tipping Point #9: The Dying U.S. Dollar

The euro is not the only major currency that is in trouble.

The U.S. dollar is also slowly dying.

On April 18th, Standard & Poor’s altered its outlook on U.S. government debt from "stable" to "negative" and warned that the U.S. could soon lose its prized AAA rating.

The sad truth is that faith in the U.S. dollar and in U.S. Treasuries is rapidly declining. The mainstream news is not reporting on it much, but right now the Chinese are rapidly dumping U.S. government debt.

As the dollar declines, so will the purchasing power of average Americans. We are already seeing a tremendous amount of inflation in 2011.

But this is just the beginning.

A lot worse is going to be coming down the road.

Tipping Point #10: Drought

A lot of people that read my articles doubt that we will ever see a major global food crisis.

But one is coming.

It is just a matter of time.

Even now, many areas of the world are experiencing very serious droughts. The following is from a recent Bloomberg article....

Parts of China, the biggest grower, had the least rain in a century, some European regions are the driest in 50 years and almost half the winter-wheat crop in the U.S., the largest exporter, is rated poor or worse. Inventory is dropping 8.8 percent, the most in five years, Rabobank International says. Prices will advance 20 percent to as high as $9.25 a bushel by Dec. 31, a Bloomberg survey of 14 analysts and traders shows.

Are you concerned yet?

You should be.

But if you prefer some mindless pablum that will make you feel better, we have some of that for you too.

Larry Summers, the former director of the National Economic Council under Barack Obama, recently told CNBC the following....

"We definitely hit a slower patch, but I think the basic fact that the terrible financial strains we had are abating, remains in place, and I expect this recovery to continue for a substantial period of time."

Does that make you feel better?

Larry Summers says that everything is going to be okay.

It would be great if Summers was actually right, but sadly he is not.

In fact, the worst economic times that America has ever seen are ahead.

The following is a brief excerpt from a recent interview with Dmitry Orlov about the coming economic collapse that was posted on shtfplan.com....

First you have financial collapse, which is basically the volume of debt that has to be taken on in order for the economy to continue functioning, cannot continue. We’re seeing that right now in Greece, we’re probably going to see that in Japan, we’re definitely at a point now in the United States where even if you raised the income tax to 100 percent, there’s absolutely no way of covering the liabilities of the U.S. federal government. So, we’re at that point now but the workout of the financial collapse is not all quite there. We don’t quite have a worthless currency but that’s in the works.

That, of course, is followed by commercial collapse especially in a country like the United States that imports two thirds of its oil. A lot of that is on credit and if a little bit of that oil goes missing then the economy starts to fall apart because nothing moves unless you burn oil in the United States and, of course, a lot of goods that are sold everywhere are imported again, on credit.

When the U.S. dollar dies and our financial system collapses we are not going to be able to get all of the things that we need from the rest of the world so cheaply any longer.

That is going to cause fundamental changes inside the United States.

Right now, the economic news just seems to get worse and worse, but this is just the beginning.

What is eventually going to happen in this country is going to be so nightmarish that most Americans could not even imagine it right now.

So are our leaders doing anything to prepare for the coming economic crisis?

No, they are too busy with other things.

The big political news of the day was U.S. Representative Anthony Weiner finally admitting that he sent out lewd photos of himself over Twitter to women that he was not married to.

We have become the laughingstock of the world and the economic collapse has not even happened yet.

Link to this article here: