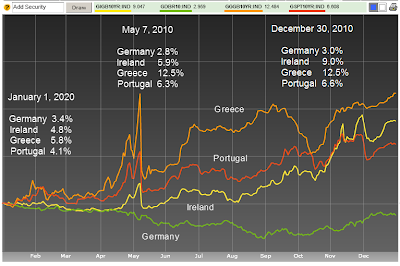

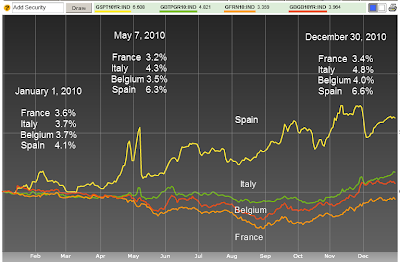

The bailouts to Greece and Ireland solved nothing.Spain and Portugal are up next.The sovereign debt crisis in Europe is still simmering.Country by country,spreads to German debt are at or near

record levels.

Chart follow snips from German Bonds Climb in 2010 as Fiscal Crisis Roils Euro Area

German bunds climbed in 2010,the best performance since 2008,as the fiscal crisis that roiled the euro area’s most-indebted nations drove investors to the safest

fixed-income assets in the region.

Top-rated euro-denominated securities from Austria,Germany,the

Netherlands,Finland and France led gains in 2010,while the debt of

Greece and Ireland,which sought bailouts this year,had the biggest

losses among 26 markets tracked by Bloomberg and the European

Federation of Financial Analysts Societies.

German bonds returned a profit of almost 6 percent this year,

according to the Bloomberg/EFFAS data, compared with a 20 percent

loss on Greek debt, a 14 percent slump in Irish securities and an 8

percent decline for Portuguese securities. Spanish and Italian bonds

also made a loss as investors demanded increasing yields to own the

debt of the euro area’s high-deficit nations.

As borrowing costs climbed again amid a wave of sovereign downgrades

that saw Greek debt cut to non-investment grade at Moody’s Investors

Service and Standard & Poor’s,Ireland opted on Nov. 28 to follow

Greece, accepting an 85 billion-euro bailout.That,too, failed to

prevent the spread of the debt crisis, fueling investor concern that

Europe’s stronger nations may be unwilling or unable to foot the

cost of future rescues.

The extra yield investors demand to hold Greek 10-year government

bonds instead of German bunds, Europe's benchmark government

securities, surged to a euro-era record of 973 basis points on May

7, and was at 953 basis points today. It started the year at 239

basis points. The difference in yield, or spread, between German

bonds and 10-year debt from Ireland, Portugal, Spain and Italy also

reached euro-era records.

Germany, Ireland, Portugal, Greece Sovereign Debt Yields | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

France, Spain, Belgium, Italy Sovereign Debt Yields | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| Mish's Global Economic Trend Analysis, Mike 'Mish' Shedlock Dec31,2010 | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

Comments