Italy’s debt-to-GDP ratio is 118% (2009).Greece got in trouble at 116%. Italy’s deficit is smaller and has a high savings ratio.However,nobody focuses on that as Spain is in the limelight with a debt-to-GDP ratio under 60%.Should austerity measures result in a nominal GDP contraction in Italy,its debt stats will worsen very rapidly.

Italy’s debt-to-GDP ratio is 118% (2009).Greece got in trouble at 116%. Italy’s deficit is smaller and has a high savings ratio.However,nobody focuses on that as Spain is in the limelight with a debt-to-GDP ratio under 60%.Should austerity measures result in a nominal GDP contraction in Italy,its debt stats will worsen very rapidly.

Italy is the elephant in the room not Spain.

Since mid-October, German 10-Year Government bond yields are up .64%. In the same timeframe, Italian 10-Year Government bond yields are up 1.04%.

Since mid-October, German 10-Year Government bond yields are up .64%. In the same timeframe, Italian 10-Year Government bond yields are up 1.04%.

The flight-to-safety divergence increased starting around December 16, 2010. Since then, German bonds yields are off .16% while Italian bond yields rose .14%.

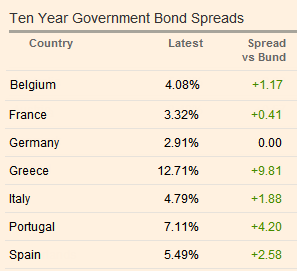

Government Bond Spreads as of January 7, 2011

On January 7, 2011 the German-Italian spread government bond spread is 1.88% and rising. Table is courtesy of the Financial Times.

Note:As of back in May 2010,Italy owed France a whopping $511 billion, 20% of the French GDP.Moreover,nearly 1/3 of Portugal’s debt is held by Spain.Meanwhile Spain owes huge amounts to Germany, France, and the UK.

Critical Court Ruling Coming Up................

In Feb 2011 the German court gives its verdict on the constitutionality of the bail-out. Fifty academics and politicians sued the government over it.February is crunch time.

If Italy were to go into a nominal GDP recession on account of its austerity programs,its debt-to-GDP ratio would likely be 130% by 2012.It’s difficult to see how the market would ignore that.

Also check out Italy’s debt compared to Germany. Here is the official EU Gross Government Debt Figures by country.Note that as of 2009, Italy’s Debt is 1.763 Trillion EUR,about the same as Germany. Obviously the German economy is far bigger.

2011 Italian Debt Issuance

Inquiring minds are reading Italian Public Securities By Maturity to see how much debt Italy will need to rollover in 2011.

A quick look at page 3 totals approximately 281 billion in euro debt rollovers. Assume a 5% budget deficit on a GDP of roughly 1.5 trillion euros and you end up with 281 + 75 billion or roughly 356 billion euro total debt issuance.

Will the market accommodate that issuance at a good interest rate? If not, the “Invisible Elephant In The Room” will quickly make its presence known in a rather rude manner.

Comments