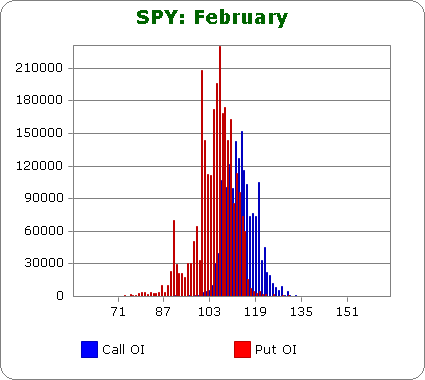

Puts outnumber calls 2.5-to-1.

Call OI is biggest between 107-116 with the 112, 113 and 114 being the 3 most popular strikes.

Put OI is biggest between 100-113 with the OI at 110 and below being most popular.

Since puts far outnumber call, to determine what price would cause the most pain, let’s focus on put OI. Since most of the higher-OI strikes are at 110 and below, the ideal close would be at 110 or above so all these strikes close worthless. But we don’t want to move too far up or else more of the call strikes will be further in money. Bottom line: a slight move up from the current level would cause the most pain and frustration.

DIA (

102.81)

Comments